Anúncios

Understanding Interest on Savings Accounts

When you deposit money in a savings account, the bank pays you interest for keeping your money there. This interest can be simple or compound.

Simple interest is calculated on the initial amount of money you deposited, while compound interest is calculated on the initial amount plus any interest you’ve earned over time.

How to Calculate Simple Interest

Simple interest can be calculated using the formula:

Interest=P×R×T

Where:

- P is the principal amount (initial deposit).

- R is the annual interest rate (as a decimal).

- T is the time the money is deposited for, in years.

Example:

If you deposit $10,000 at an annual interest rate of 4%, the simple interest for one year would be:

Interest=10,000×0.04×1=400

So, you would earn $400 in interest.

Simple Interest vs. Compound Interest

While simple interest is straightforward, most savings accounts offer compound interest, which means you earn interest on your interest. This results in higher returns over time.

Compound Interest Calculation

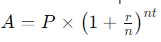

To calculate compound interest, use the formula:

Where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount.

- r is the annual interest rate (as a decimal).

- n is the number of times that interest is compounded per year.

- t is the number of years the money is invested for.

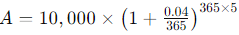

Example Calculation for Compound Interest

Suppose you have $10,000 in an account with a 4% annual interest rate, compounded daily:

Anúncios

After 5 years, this would result in approximately $12,214, thanks to the power of compounding.

Additional Tips for Maximizing Interest Earnings

- Choose High-Interest Accounts: Opt for accounts with high APYs to maximize your earnings.

- Regular Deposits: Make regular deposits to boost your balance and interest earnings.

- Monitor Interest Rates: Keep an eye on interest rates and consider moving your money if better rates are available.

Table: Simple vs. Compound Interest for $10,000 at 4% Over 5 Years

| Year | Simple Interest | Compound Interest (Daily) |

|---|---|---|

| 1 | $400 | $408 |

| 2 | $800 | $833 |

| 3 | $1,200 | $1,275 |

| 4 | $1,600 | $1,735 |

| 5 | $2,000 | $2,214 |

How to Earn More Interest

- High-Yield Accounts: Look for online banks offering higher interest rates.

- Regular Contributions: Consistently add to your savings to compound interest.

- Compare Options: Use savings calculators to compare potential earnings from different accounts.

Importance of Regular Deposits

Making regular deposits in your savings account can significantly boost your savings. Even small, consistent contributions can accumulate substantially over time, especially with compound interest.

Anúncios

Factors Affecting Interest Earnings

- Interest Rate: Higher rates yield more interest.

- Compounding Frequency: More frequent compounding results in higher interest.

- Deposit Amount: Larger deposits earn more interest.

- Deposit Duration: Longer periods allow more time for interest to compound.

Choosing the Right Account

Look for accounts with higher interest rates and favorable compounding terms. Online banks often offer competitive rates compared to traditional banks. Consider high-yield savings accounts or certificates of deposit (CDs) for better returns.

Monitoring Your Savings

Regularly check your account statements to track interest earnings and ensure you’re on target with your savings goals. Use online calculators to estimate future interest earnings and adjust your savings strategy as needed.

Tax Implications

Interest earned on savings accounts is generally taxable. Be sure to report it on your tax return to avoid penalties. Consult a tax professional if you have questions about your specific situation.